Introduction

Welcome to Investiit.com Tips, your ultimate resource for actionable advice and strategies to enhance your investment journey. Whether you’re a seasoned investor or just starting, the world of investing can be both exciting and complex. This comprehensive guide aims to provide you with practical tips and insights to make informed investment decisions, maximize returns, and achieve your financial goals. From understanding market trends to selecting the right investment vehicles, we will cover everything you need to know to navigate the investment landscape effectively.

1. Understanding the Basics of Investing

Before diving into advanced strategies, it’s essential to grasp the fundamental concepts of investing. Here’s a primer on the basics to get you started:

1.1 What is Investing?

- Definition:

Investing involves allocating resources, typically money, into assets or ventures with the expectation of generating future returns. The goal is to grow your wealth over time.

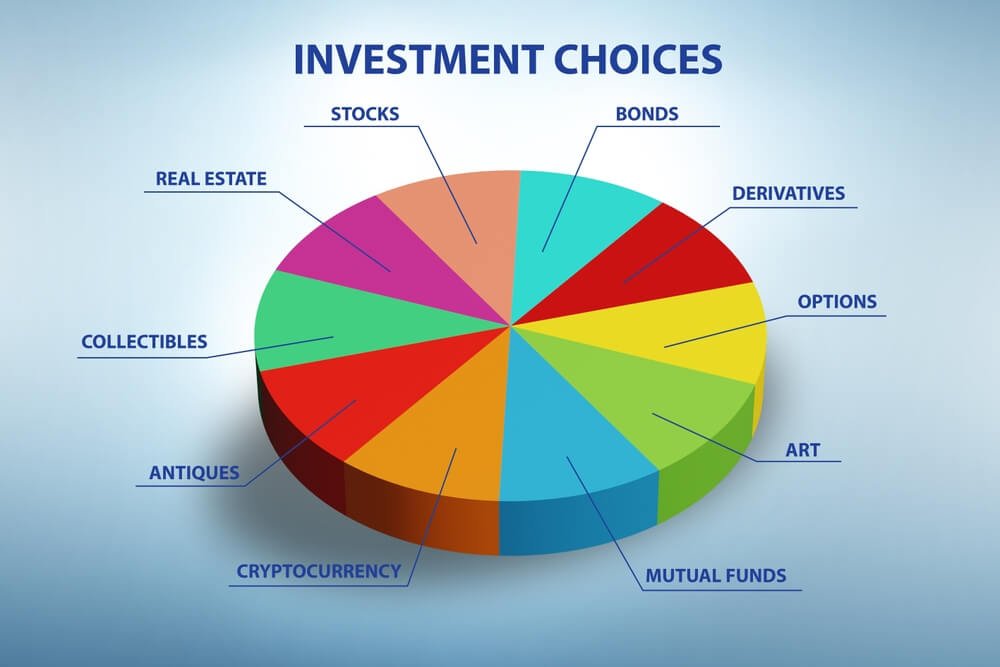

- Types of Investments:

Common investment types include stocks, bonds, real estate, mutual funds, and exchange-traded funds (ETFs). Each type has its own risk and return profile.

1.2 Why Invest?

- Wealth Growth:

Investing helps grow your wealth by generating returns on your initial investment. Over time, compounding can significantly increase your investment value.

- Retirement Planning:

Investments are crucial for building a retirement fund. A well-structured investment portfolio can provide a steady income during retirement.

2. Crafting a Winning Investment Strategy

A solid investment strategy is crucial for achieving long-term success. Here’s how to craft one with Investiit.com Tips:

2.1 Set Clear Financial Goals

- Short-Term Goals:

These may include saving for a vacation, buying a car, or building an emergency fund. For short-term goals, consider lower-risk investments like savings accounts or short-term bonds.

- Long-Term Goals:

Long-term goals typically involve retirement savings or purchasing a home. For these, higher-risk investments such as stocks or real estate might offer greater returns.

2.2 Understand Your Risk Tolerance

- Risk Assessment:

Your risk tolerance depends on your investment time horizon, financial situation, and personal comfort with market fluctuations. Higher risk often comes with higher potential returns, but also greater volatility.

- Risk Management:

Diversify your investments to spread risk across different asset classes. This can help mitigate potential losses and stabilize returns.

2.3 Diversify Your Portfolio

- Asset Allocation:

Diversify across various asset classes such as stocks, bonds, and real estate to reduce risk. Different assets perform differently under varying market conditions.

- Geographic Diversification:

Consider investing in international markets to gain exposure to global growth opportunities and reduce reliance on any single economy.

3. Research and Analysis

Informed investing requires thorough research and analysis. Here’s how to effectively utilize Investiit.com Tips for research:

3.1 Analyze Market Trends

- Economic Indicators:

Monitor economic indicators such as GDP growth, unemployment rates, and inflation. These indicators can provide insights into overall market conditions and potential investment opportunities.

- Industry Trends:

Stay updated on industry-specific trends that might impact your investments. For instance, technological advancements can influence the performance of tech stocks.

3.2 Evaluate Investment Options

- Stock Analysis:

Assess stocks based on financial statements, earnings reports, and valuation metrics such as the Price-to-Earnings (P/E) ratio. Look for companies with strong fundamentals and growth potential.

- Fund Analysis:

For mutual funds or ETFs, review their historical performance, expense ratios, and management teams. Choose funds that align with your investment goals and risk tolerance.

3.3 Use Investment Tools

- Online Platforms:

Leverage online investment platforms and tools available on Investiit.com to analyze market data, track performance, and execute trades.

- Financial Calculators:

Use financial calculators to estimate future returns, assess investment needs, and plan your financial goals.

4. Risk Management and Mitigation

Managing risk is crucial for protecting your investments and ensuring long-term success. Here’s how to approach risk management with Investiit.com Tips:

4.1 Implement Stop-Loss Orders

- Purpose:

Stop-loss orders automatically sell an asset when its price falls below a certain level. This helps limit potential losses and protect your investment from significant declines.

- Setting Stop-Loss Levels:

Determine appropriate stop-loss levels based on your risk tolerance and investment strategy. Avoid setting stop-loss orders too close to the current price to prevent premature selling.

4.2 Regularly Review Your Portfolio

- Performance Monitoring:

Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

- Adjustments:

Make adjustments based on changes in your financial situation, market conditions, or investment objectives. This may involve shifting investments between asset classes or sectors.

4.3 Stay Informed

- Market News:

Keep up with the latest financial news and developments that could impact your investments. Subscribe to reputable financial news sources and follow market trends.

- Expert Opinions:

Seek advice from financial experts or advisors if needed. They can provide valuable insights and guidance tailored to your specific financial situation.

5. Investing in Different Asset Classes

Investing across various asset classes can help diversify your portfolio and manage risk. Here’s a closer look at different asset classes:

5.1 Stocks

- Types of Stocks:

Invest in a mix of blue-chip stocks, growth stocks, and dividend stocks based on your investment goals. Blue-chip stocks are typically stable and reliable, while growth stocks offer higher potential returns.

- Stock Picking:

Focus on companies with strong financial health, competitive advantages, and growth potential. Research industry leaders and emerging players to identify promising opportunities.

5.2 Bonds

- Bond Types:

Consider government bonds, corporate bonds, and municipal bonds based on your risk tolerance and income needs. Government bonds are generally lower-risk, while corporate bonds offer higher yields.

- Bond Ratings:

Review bond ratings from credit agencies to assess the creditworthiness of bond issuers. Higher-rated bonds are considered safer but may offer lower yields.

5.3 Real Estate

- Direct Investment:

Invest in physical properties such as residential, commercial, or rental properties. Real estate can provide rental income and potential appreciation.

- REITs:

Real Estate Investment Trusts (REITs) allow you to invest in real estate without owning physical properties. REITs offer diversification and liquidity, with returns coming from dividends and capital gains.

6. Utilizing Investiit.com for Investment Success

Investiit.com offers a wealth of resources and tools to support your investment journey. Here’s how to leverage Investiit.com Tips effectively:

6.1 Access to Expert Advice

- Investment Guides:

Explore detailed investment guides and articles on Investiit.com for insights into various investment strategies, asset classes, and market trends.

- Expert Opinions:

Benefit from expert analysis and opinions provided on Investiit.com. These insights can help you make informed decisions and stay updated on market developments.

6.2 Utilize Interactive Tools

- Investment Calculators:

Use interactive calculators available on Investiit.com to estimate returns, plan your investment strategy, and assess your financial needs.

- Portfolio Tracker:

Track your investments and monitor portfolio performance with the tools provided on Investiit.com. This can help you stay on top of your investment goals and make necessary adjustments.

6.3 Stay Updated

- Market News:

Keep up with the latest market news and updates through Investiit.com. Staying informed about market conditions, economic indicators, and investment trends is crucial for successful investing.

- Educational Resources:

Access educational resources and webinars on Investiit.com to enhance your knowledge and skills in investing. Continuous learning can help you adapt to changing market conditions and improve your investment strategies.

Conclusion

In conclusion, Investiit.com Tips offers valuable guidance and resources for navigating the complex world of investing. By understanding the basics, crafting a solid investment strategy, conducting thorough research, managing risk, and utilizing available tools, you can make informed decisions and work towards achieving your financial goals.

Whether you’re looking to grow your wealth, plan for retirement, or diversify your investment portfolio, the tips and insights provided in this guide will help you make smarter investment choices. Embrace the power of informed investing with Investiit.com Tips and take control of your financial future.

Stay updated, stay informed, and invest wisely with the help of Investiit.com. Your journey to successful investing starts here!